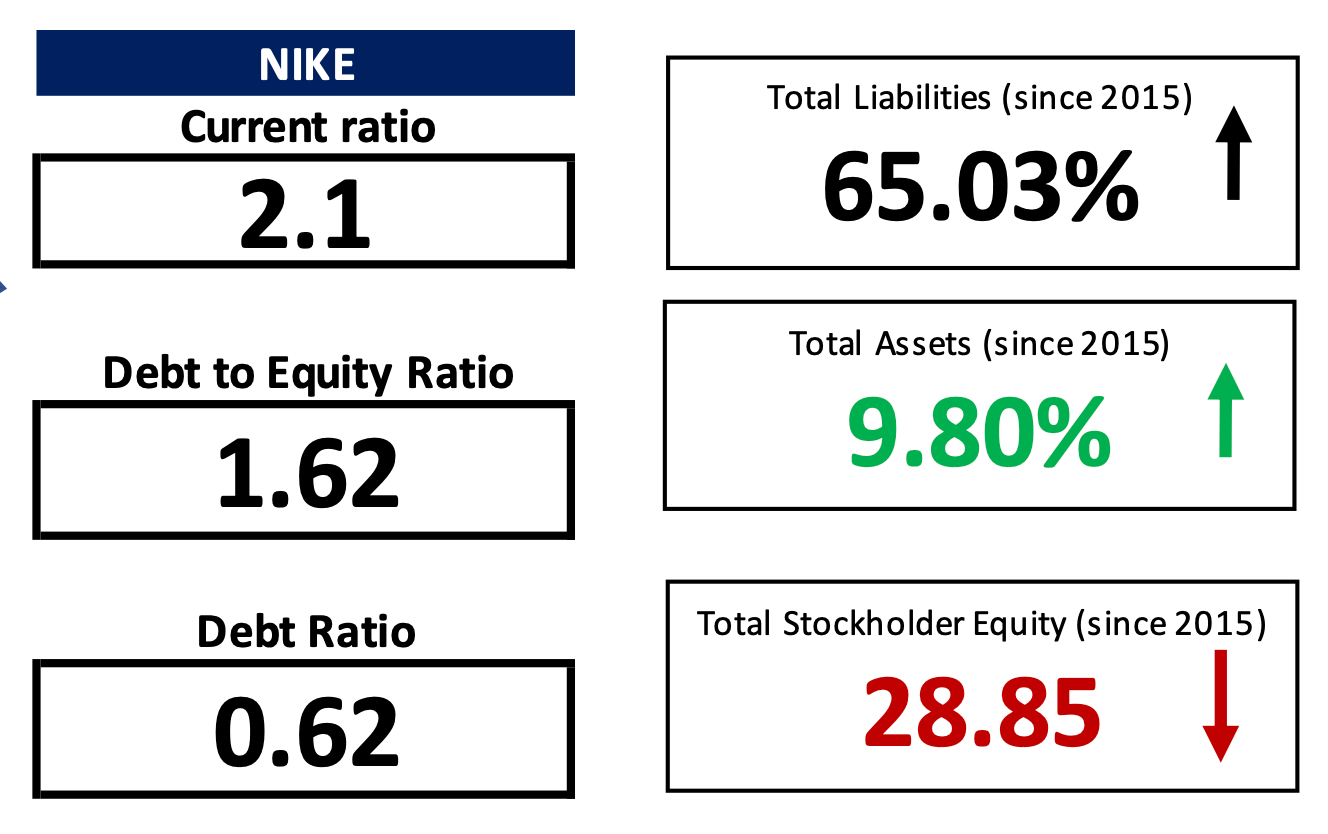

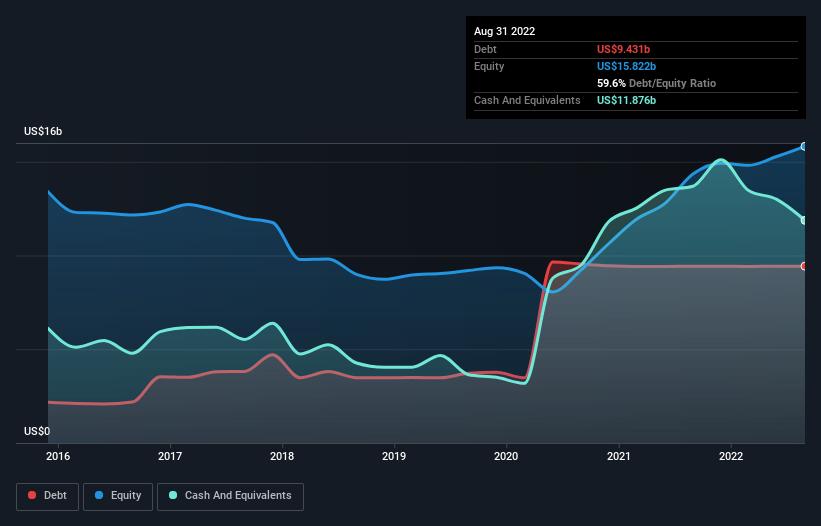

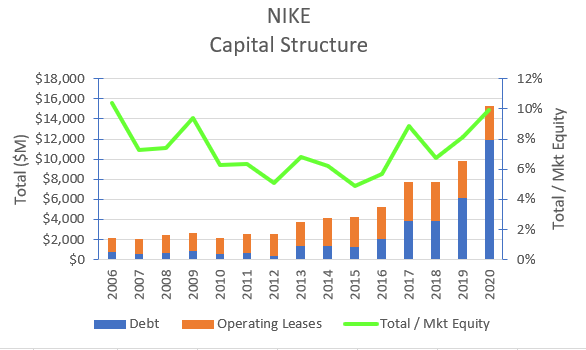

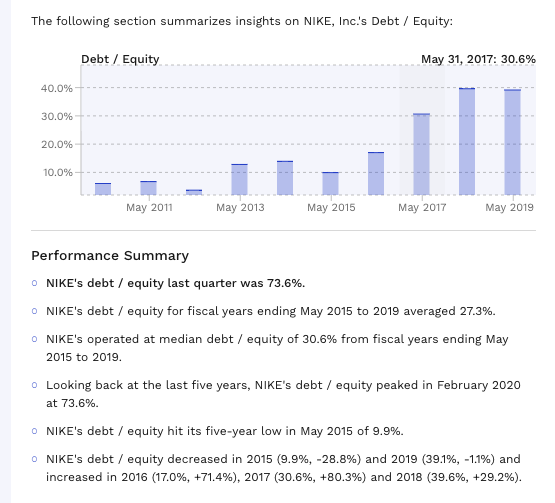

Balance Sheet Consideration When Determining Long-Term Debt-Paying Ability in Financial Reporting and Analysis Tutorial 28 October 2022 - Learn Balance Sheet Consideration When Determining Long-Term Debt-Paying Ability in Financial Reporting and Analysis

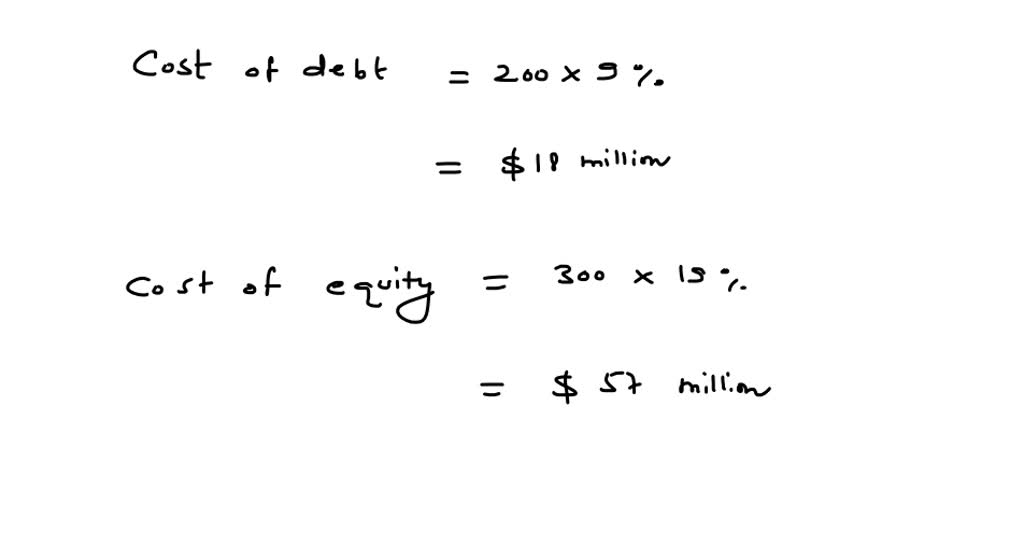

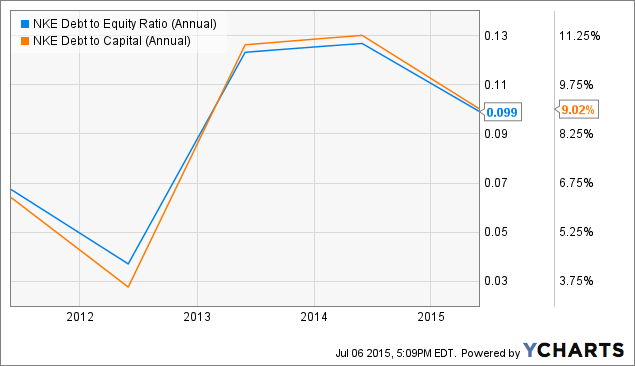

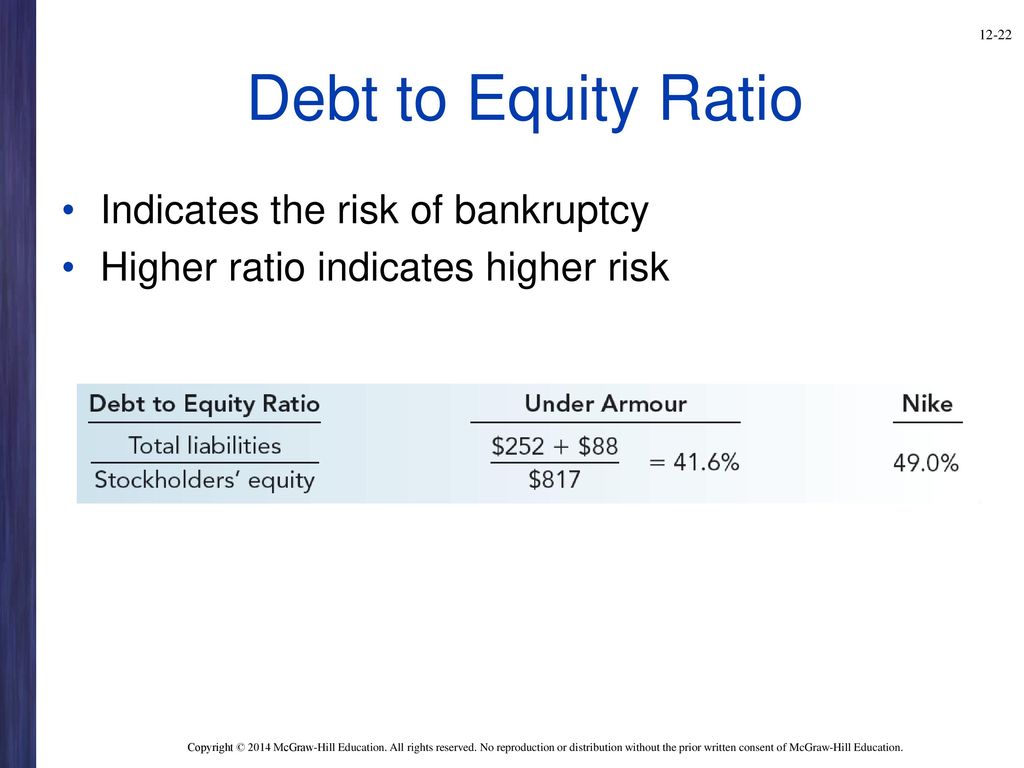

SOLVED: Nike, Inc., has a debt-equity ratio of 2.3. The firm's weighted average cost of capital is 10 percent and its pretax cost of debt is 6%. The tax rate is 24%.

.png)

:max_bytes(150000):strip_icc()/TermDefinitions_Debt-to-CapitalRatio-c25b169207f64c2d8759194ba8be3aa9.jpg)